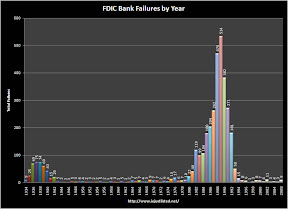

Friday is the most common day for your friendly neighborhood regulator to lock the doors of your the local bank and take it over. The FDIC is keeping busy these days with yet another bank failure. On August 22, 2008 The Columbian Bank and Trust, Topeka, KS was taken over by the FDIC. That brings us to a total of 9 this year. The real question is if the failures of 2008 are the beginning of a 1980-1993 period or more like the period of 1994-2007? The answer to that will be in the numbers for 2008-2009.

Click image for large view of graph

The FDIC has been getting prepared for the coming bank failures for some time now. The FDIC announced on Tuesday, August 22, 2008, that in the second quarter 117 banks and thrifts were considered to be trouble. That is the highest level in 5 years.From MSNBC.com: Mortgage mess puts more banks at risk

The mortgage mess that has upended millions of homeowners’ finances is now taking a bigger bite out of the nation’s banking system.

And while depositors with insured accounts face little risk of losing their money, the insurance fund’s top regulator said it may have to borrow money from the Treasury to make good on that promise to consumers.

...

So far, only nine lenders have failed this year, the largest of which was Pasadena, Calif.-based IndyMac, which was taken over by the FDIC in July with about $32 billion in assets and $19 billion in deposits. It was the second-largest financial institution to close in U.S. history, after Continental Illinois National Bank in 1984.

Those failures have depleted the insurance fund, which now stands at $45 billion — less than the FDIC is supposed to have on hand, according to Daniel Alpert, an investment banker at Westwood Capital.

...

Bair also told the Wall Street Journal the FDIC couldn’t rule out the possibility that it may have ask the Treasury for capital to tide it over through the coming round of bank failures. The money would be used to pay depositors insurance claims, and then paid back after the assets of the failed bank are sold.

Search the Inland Empire are MLS no registration required!

What is your home is worth? No registration required.